Instant Access

No Waiting, Start Streaming Now

24/7 Support

Always Here to Help

Multi-Device

Watch on Any Screen

8K Quality

Crystal Clear Streaming

Instant Access

No Waiting, Start Streaming Now

24/7 Support

Always Here to Help

Multi-Device

Watch on Any Screen

8K Quality

Crystal Clear Streaming

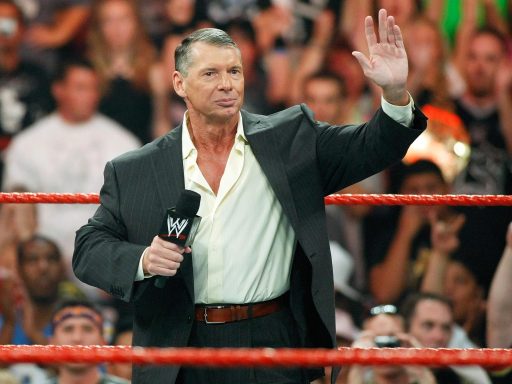

In the high-stakes arena of professional wrestling and corporate governance, few names resonate as powerfully as Vince McMahon. The titan behind World Wrestling Entertainment (WWE) has long been a figure of intrigue and controversy, deftly navigating the ring while simultaneously engaging in the complex world of business ethics and regulatory scrutiny. Recently,McMahon found himself in the crosshairs of the U.S. Securities and Exchange Commission (SEC), leading to a climactic resolution that marks a significant chapter in both his career and the evolving narrative of corporate accountability.As these two formidable entities reach a settlement agreement, the implications ripple far beyond the squared circle, offering insights into the intersections of leadership, regulation, and the relentless pursuit of power in the modern marketplace.

After months of deliberation, World Wrestling Entertainment’s Chairman Vince mcmahon has reached a landmark settlement with the U.S.Securities and Exchange Commission (SEC). The agreement resolves key issues surrounding previously disputed payments, creating new clarity on compliance standards for the corporate titan. According to official filings, McMahon and the SEC have agreed to terms that include financial penalties and revamped corporate governance measures as part of the resolution. While the finer details of the deal remain confidential, industry insiders speculate that the move signifies a step toward tightening oversight within WWE’s operations.

| Aspect | Outcome |

|---|---|

| Settlement Cost | Undisclosed Fine |

| Compliance Updates | Internal Oversight Enhanced |

| Public Impact | Restored Investor Trust |

On WWE’s part, the deal signals a concerted effort to rebuild its public image and reinforce investor confidence after months of turbulence. Industry analysts have noted that clarity and governance reforms will likely play a pivotal role in the company’s future dealings. For McMahon, this settlement represents a calculated effort to put ongoing legal issues behind him while reasserting his influence within WWE’s evolving leadership matrix.

The ongoing ordeal between Vince McMahon and the SEC reached a resolution recently with settlements that have grabbed the industry’s attention. As part of the agreement, McMahon is expected to adhere to stricter financial disclosure policies, which aim to bolster transparency for shareholders.These settlements address concerns raised during the regulator’s inquiry into prior financial reporting and McMahon’s business dealings during his tenure at WWE.

Although specific financial figures for the settlement remain undisclosed, the repercussions for WWE and its leadership are notable. Here’s a brief breakdown of the key terms of impact:

| Category | Details |

|---|---|

| Compliance Costs | Expected to rise due to ongoing audits |

| Settlement Structure | Non-public financial agreement |

| Shareholder Confidence | Improved transparency measures |

In a advancement that has sent ripples through the world of professional wrestling and corporate governance, Vince McMahon and the SEC have finalized a settlement involving WWE’s financial disclosures. As part of the agreement, the WWE Executive Chairman has committed to tighter oversight, addressing key concerns that arose in the wake of allegations regarding undisclosed payments. The deal signals a turning point for WWE’s transparency efforts and ensures stronger compliance measures moving forward.

The settlement includes specific commitments aimed at restoring confidence among stakeholders:

| Key changes | Impact |

|---|---|

| Independent Oversight Committee | Greater checks on financial systems |

| Expanded Reporting Standards | Improved shareholder transparency |

| Executive Reimbursement | Less financial burden on the company |

Vince McMahon appears prepared to leave behind the turbulence of legal challenges following his agreement with the SEC. The settlement, which addresses allegations related to undisclosed payments, brings a degree of resolution to concerns that have clouded WWE’s corporate reputation in recent months. While the terms of the deal include financial penalties, it allows McMahon to focus on larger priorities, such as WWE’s ongoing merger with UFC’s parent company, Endeavor. This agreement marks a notable shift, enabling WWE’s leadership to move forward without looming regulatory distractions.

Observers suggest that this deal might potentially be part of McMahon’s strategic pivot to secure WWE’s dominant market position while aligning with Endeavor’s vision. Internally, the settlement is already fostering discussions around setting stricter corporate governance policies. The table below highlights a few of the changes implemented at WWE following this agreement:

| Action | Impact |

|---|---|

| Increased Board Oversight | Ensures greater accountability in financial disclosures. |

| New Compliance Team | Dedicated to monitoring legal and ethical practices. |

| Enhanced Transparency Policies | Boosts investor confidence and corporate credibility. |

the settlement between Vince mcmahon and the SEC marks a significant chapter in the ongoing saga of corporate governance and accountability in the world of professional wrestling and beyond. This agreement not only underscores the regulatory body’s commitment to enforcing compliance but also reflects McMahon’s willingness to navigate the intricacies of legal challenges that have followed him throughout his storied career. As both parties move forward, this resolution may set important precedents for future interactions between high-profile executives and regulatory authorities. With the curtain drawn on this particular episode, the spotlight now shifts to how McMahon will steer WWE in a landscape increasingly shaped by legal scrutiny and public expectation.The next act in this unfolding drama promises to be both intriguing and consequential for the industry and its stakeholders.

34,353

Live TV Channels

162,404

Movies

27,802

Series

284,023

Total Subscriptions

139,854

Users Online

142,887

Total Resellers